Texas & Georgia Portfolio (All 3 Assets)

Please provide the below information to view this property's offering memorandum.

Highlights

- Strategically located in the top three high-growth markets in the Nation (Dallas-Fort Worth MSA, Houston MSA & Atlanta MSA).

- High-growth and high-barrier locations provide new ownership with three (3) irreplaceable investments with tremendous upside potential.

- Newer construction – all three properties were built between 2011 & 2012 and are 100% occupied.

- Over 40% of the portfolio GLA & over 45% of the revenue come from nationally recognized tenants

- Terrific stabilized revenue stream with upside potential through the increasing of below market rents both in the short-term and long-term.

- Nearly 47% of the portfolio provides investors with rent escalations throughout the remainder of the primary term.

- 68% of the offering has no or FMV renewal options at the end of their term. 32% offer substantial increases of 10% or more upon expiration.

- Excellent visibility and accessibility along each respective thoroughfare.

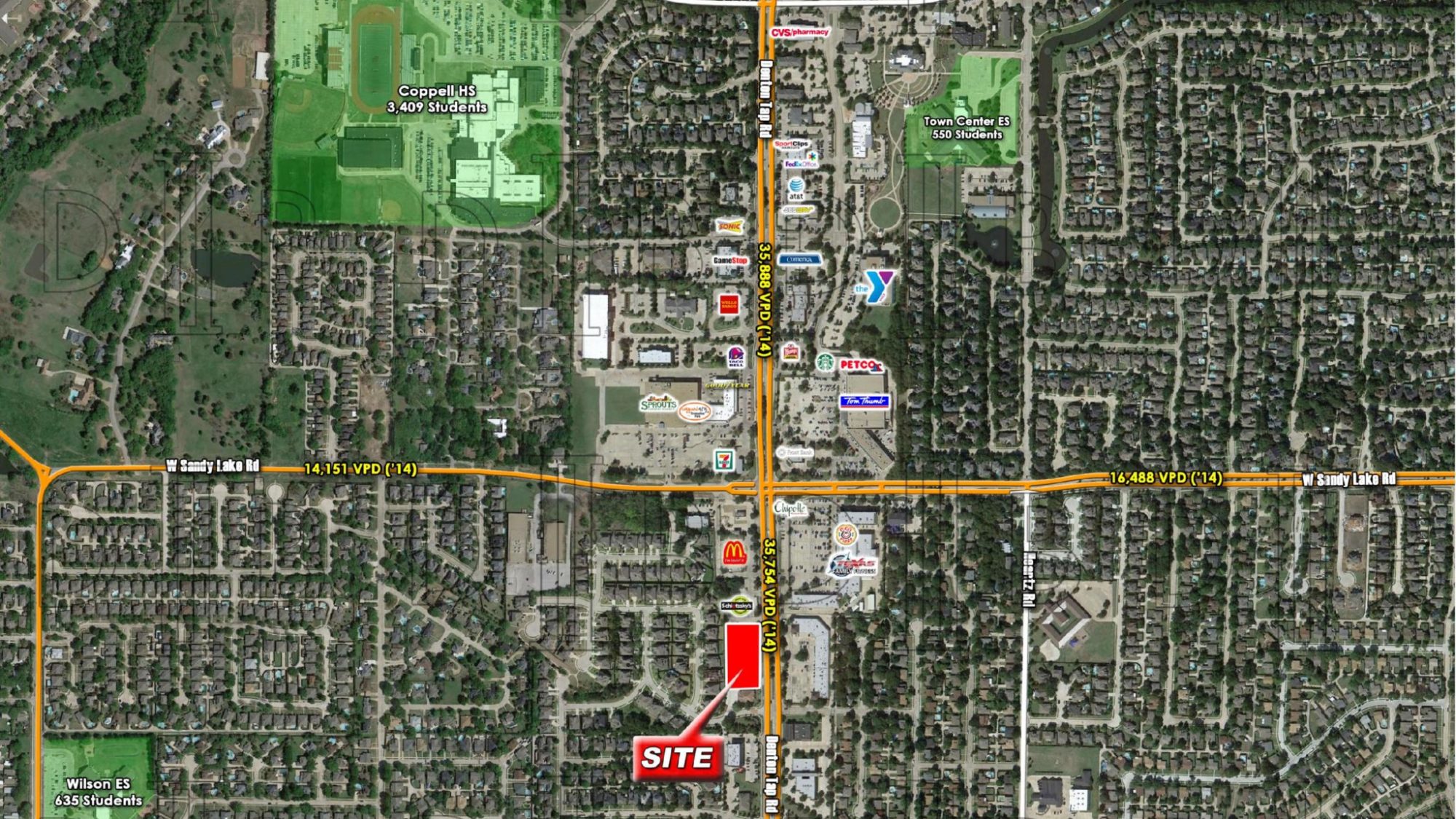

- Coppell Demographics: 78,430 to 190,193 residents with average household incomes between a staggering $104,372 and $158,688 within a 3 and 5 mile radius. 45,905 – 130,784 employees within the same respective trade range provide excellent daytime densities.

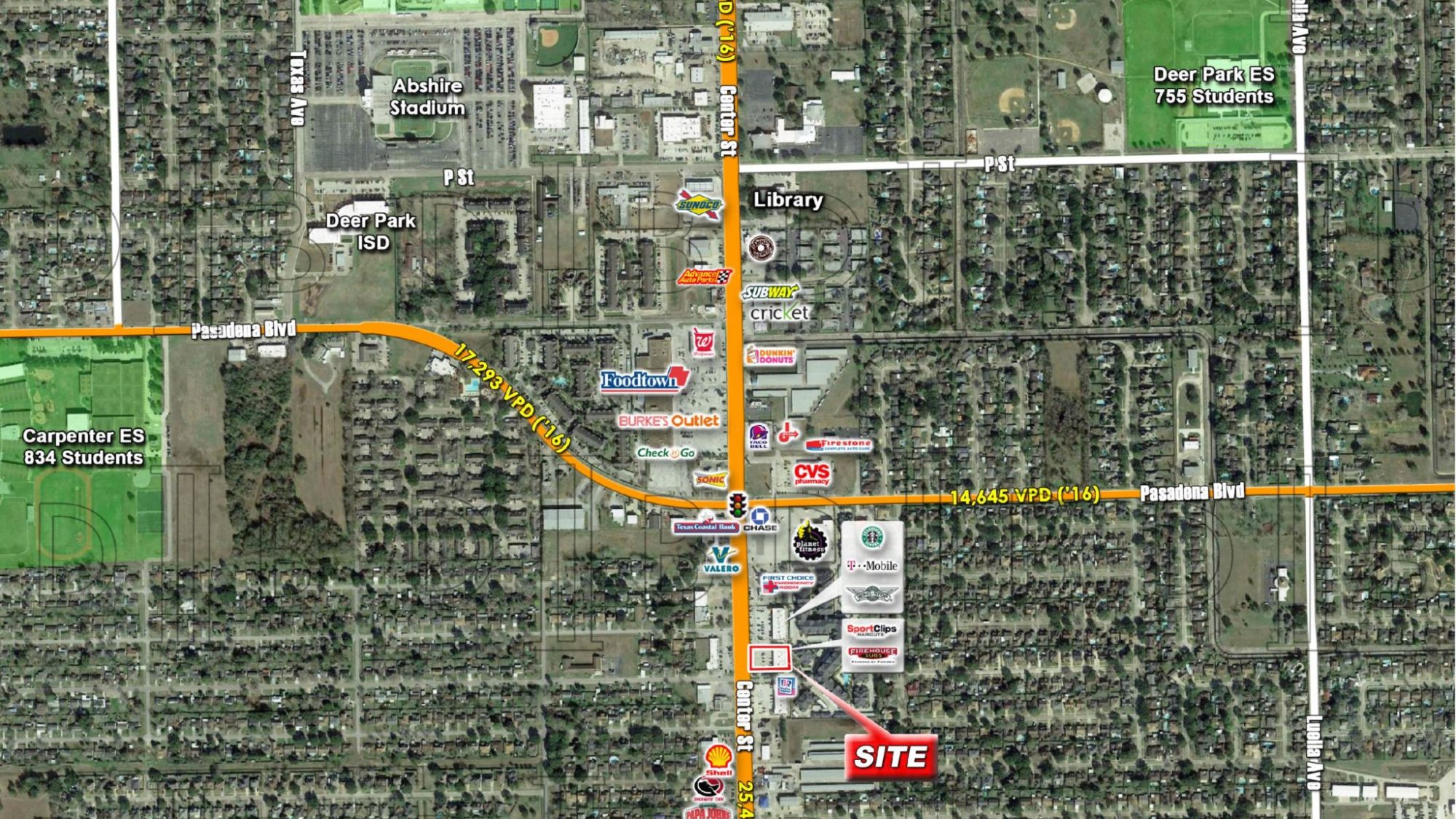

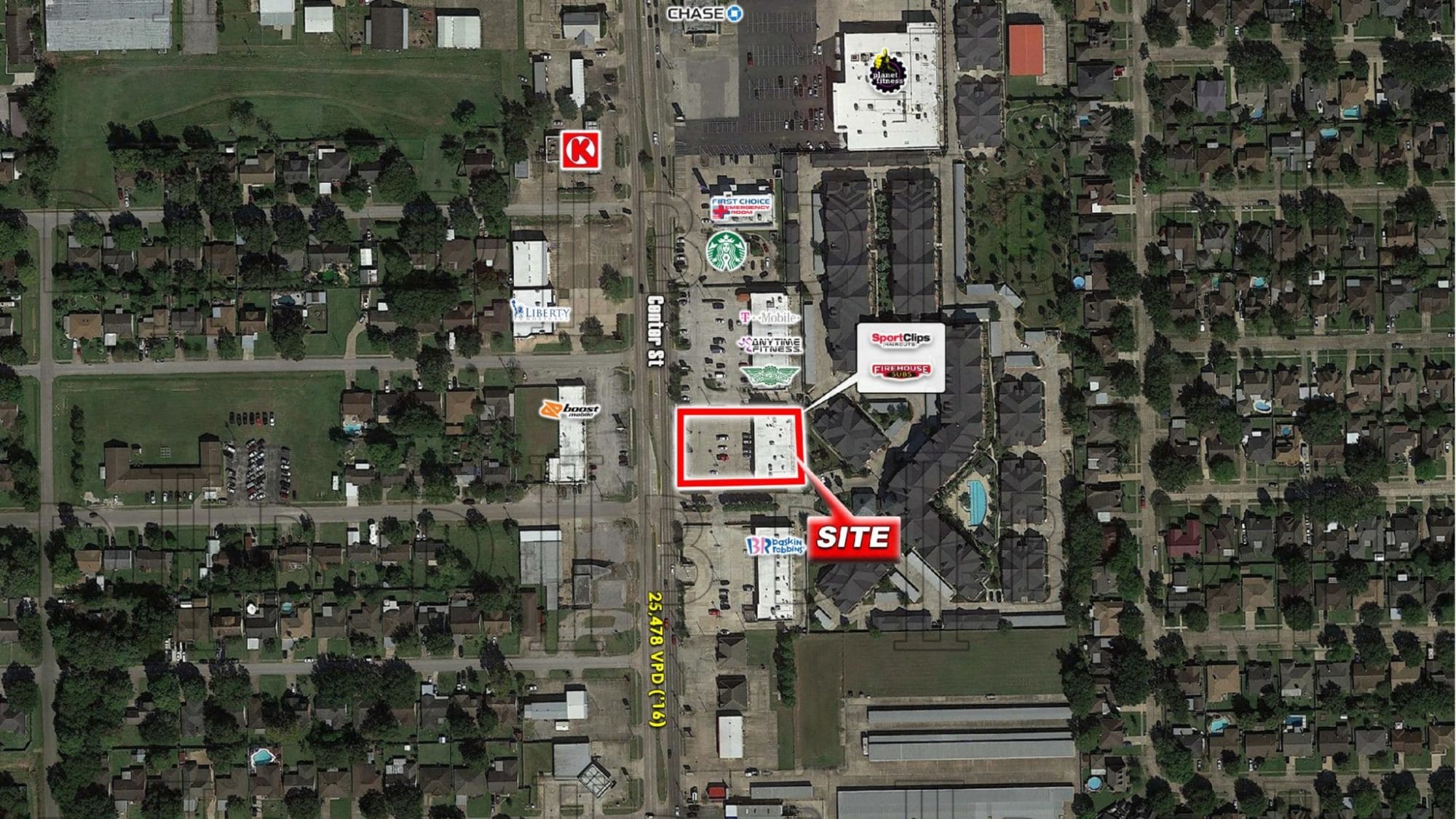

- Deer Park Demographics: 89,712 to 183,124 residents with average household incomes between $80,086 and $87,742 within a 3 and 5 mile radius. 37,403 to 74,221 employees within the same respective trade range.

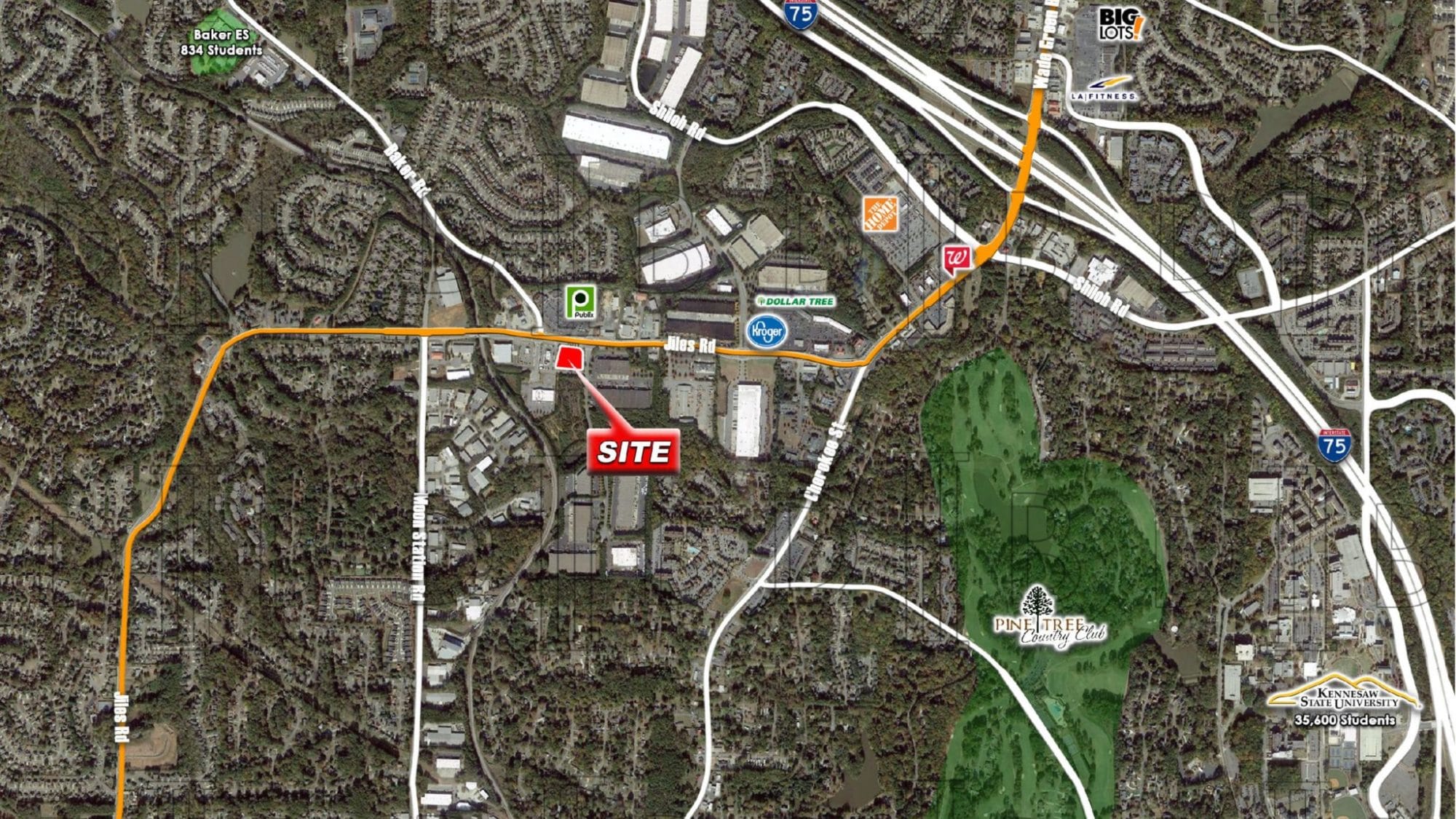

- Kennesaw Demographics: 84,831 to 180,369 residents with average household incomes between $84,322 and $88,369 within a 3 and 5 mile radius. 34,130 to 76,132 employees within the same respective trade range.

Description

DB2RE INVESTMENT SALES is pleased to offer the Texas & Georgia retail portfolio – a rare neighborhood center portfolio strategically located within the top three high-growth markets in the Nation (Dallas MSA, Houston MSA & Atlanta MSA). Comprising of three (3) assets on 3.90 acres and totaling 30,779 square feet, the portfolio is 100% occupied by a variety of national retailers which include: Dunkin Donuts, SmashBurger, Einstein Bros. Bagels, Firehouse Subs, Jersey Mikes Subs and Sport Clips, among other regional and local tenants. Over 40% of the GLA and over 45% of the revenue comes from these six (6) national retailers. Each asset boasts excellent positioning within the core of their respective market, as well as, outstanding accessibility and visibility along their primary thoroughfare. With sixteen (16) tenants across the three properties, the average size per suite is a favorable 1,923 square feet. Furthermore, over 87% of the portfolio makes up no more than 10% of the total GLA, simplifying future lease-up and day-to-day oversight / management of the portfolio. New ownership will enjoy three irreplaceable long-term investments within core high-growth / high-barrier markets. Not only does the portfolio offer investors a stabilized revenue stream with long-serving tenants, but also allows ownership to increase value in both the short-term and long-term.

Location

The "Portfolio" consists of three (3) assets (Shoppes at Coppell Manors, Shoppes at Town Square & Kennesaw Pavilion) located in Coppell, Texas (Dallas-Fort Worth MSA), Deer Park, Texas (Houston MSA) & Kennesaw, Georgia (Atlanta MSA). Seller is looking at a portfolio transaction for all three (3) assets, but will evaluate offers on each asset individually.

Texas & Georgia Portfolio (All 3 Assets)

143 S. Denton Tap Road, 3717 Center Street & 4100 NW Jiles Road, Coppell, Deer Park, Kennesaw, Dallas, Harris & Cobb County, Texas & Georgia 75019, 77536, 30144

Contact Us About this Property