11.47 AC – Core Opp Zone Portfolio – Dallas, Texas

Please provide the below information to view this property's offering memorandum.

Highlights

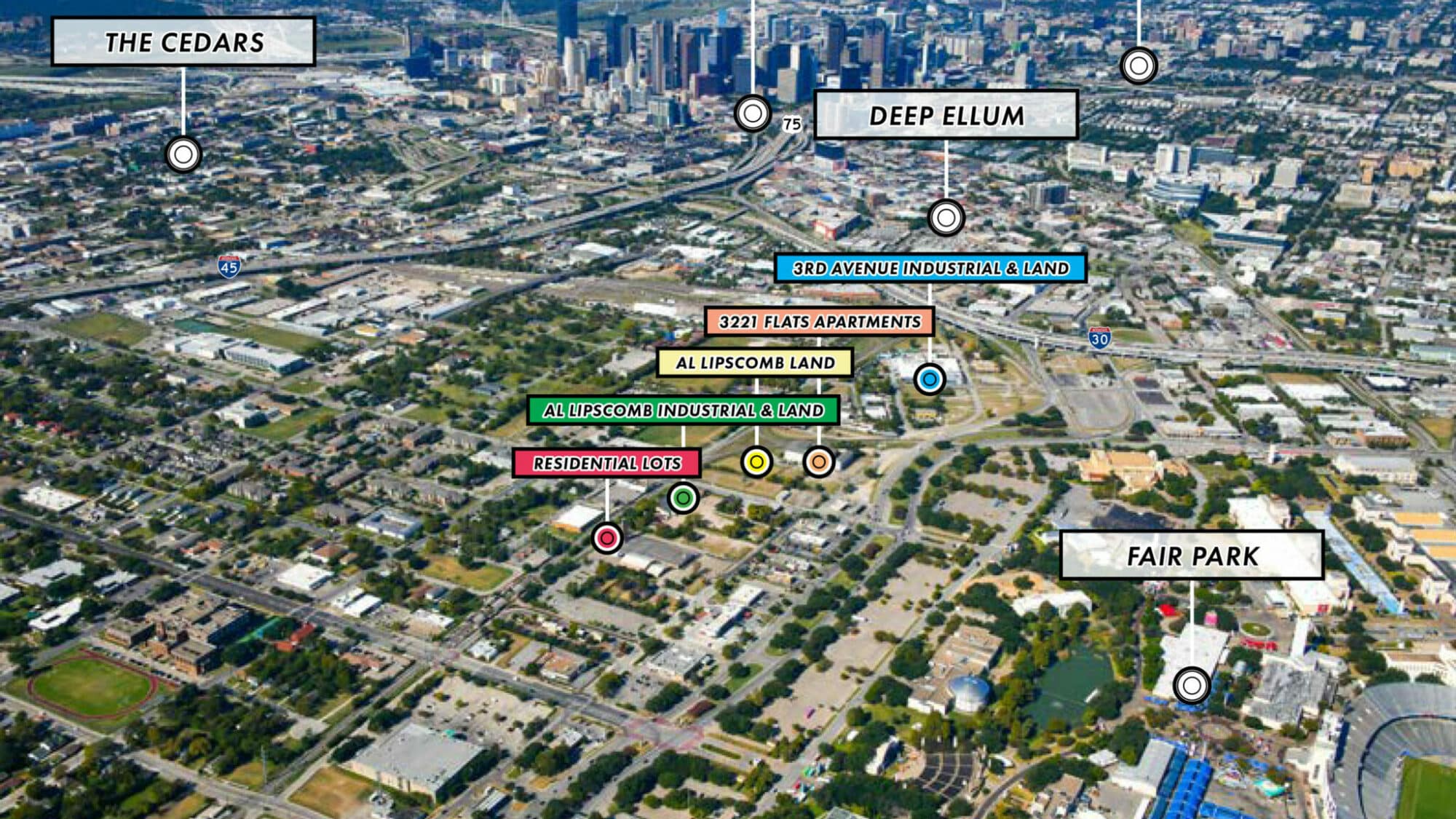

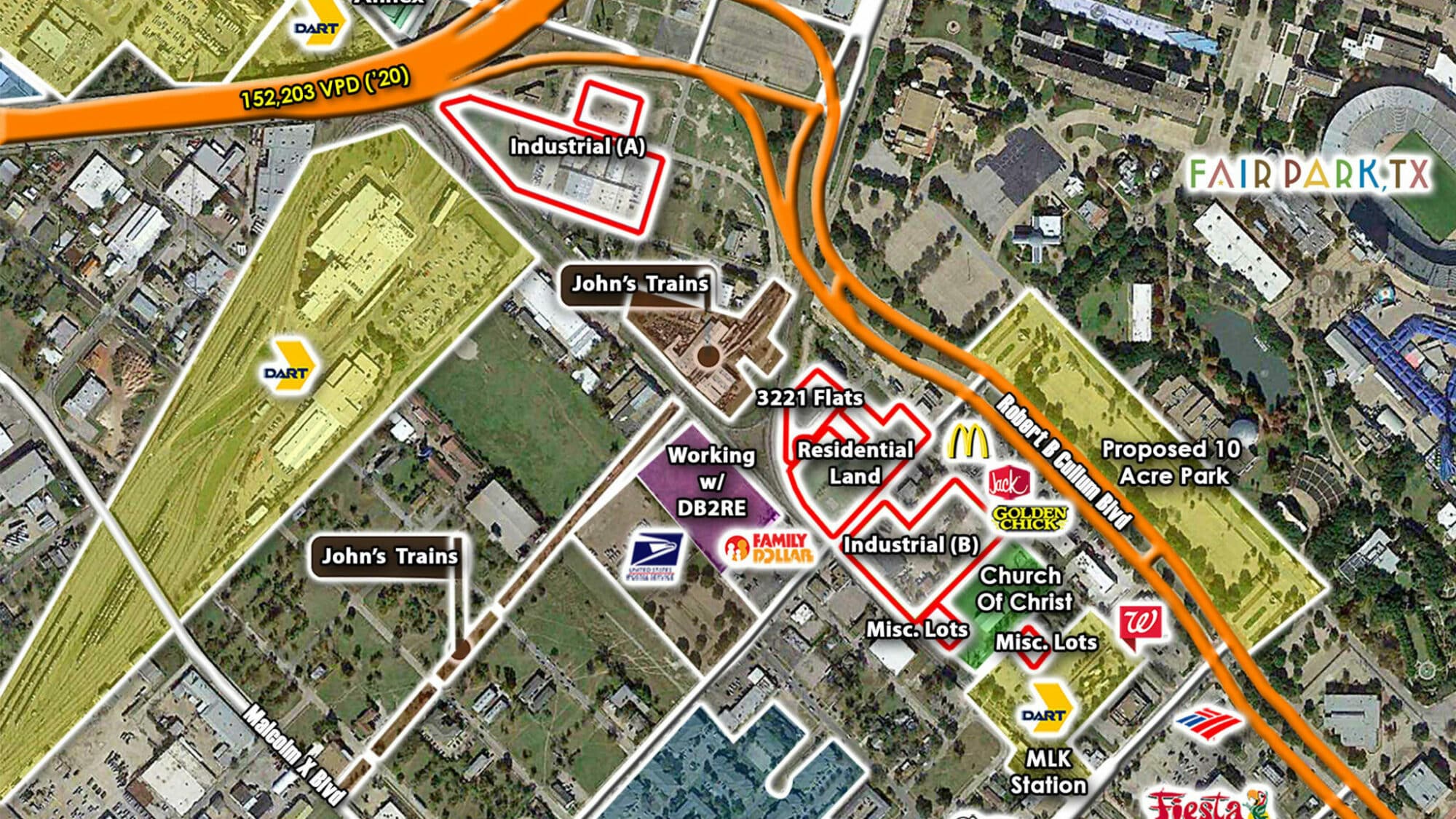

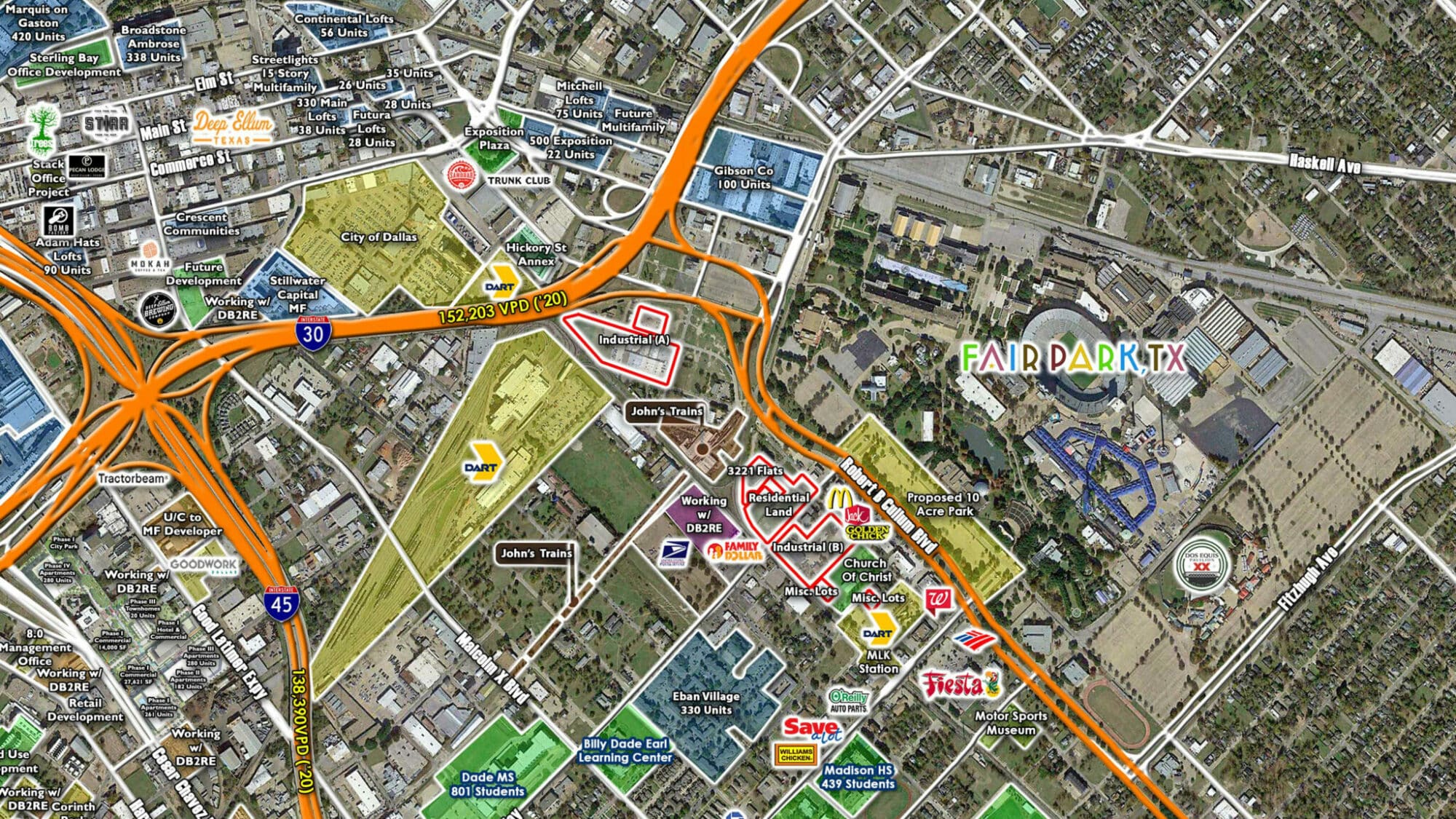

- Rare qualified Opportunity Zone investment at the entrance of Fair Park in Dallas, Texas – largest compilation of infill properties in Dallas CBD.

- Unique covered land play with immediate redevelopment opportunities and existing cash-flow which boasts an incredible value-add opportunity.

- Extremely rare urban / core portfolio totaling 11.47 AC, located within a high-growth and high-barrier of Dallas, Texas. (OFFERING CAN BE PURCHASED AS A PORTFOLIO OR SEPARATELY AS INDIVIDUAL INVESTMENTS).

- Strategically positioned just east of the coveted Deep Ellum District, home of Uber’s Dallas HQ and The Cedars, both high-growth markets. Each Property will also benefit from the $85MM + Fair Park revitalization plan.

- Unbeatable access to all major arteries (Central Expressway – Highway 75), Interstate 30, Interstate 45 and Interstate 35).

- 152,353 to 239,507 residents with average household incomes of $101,037 and $109,662 within a three and five mile radius.

- 72,467 SF multi-tenant industrial covered land play with an additional 2.31 AC of IOS land / outside storage (call for details).

- 38 unit / 48,484 SF stabilized multi-family asset (call for details).

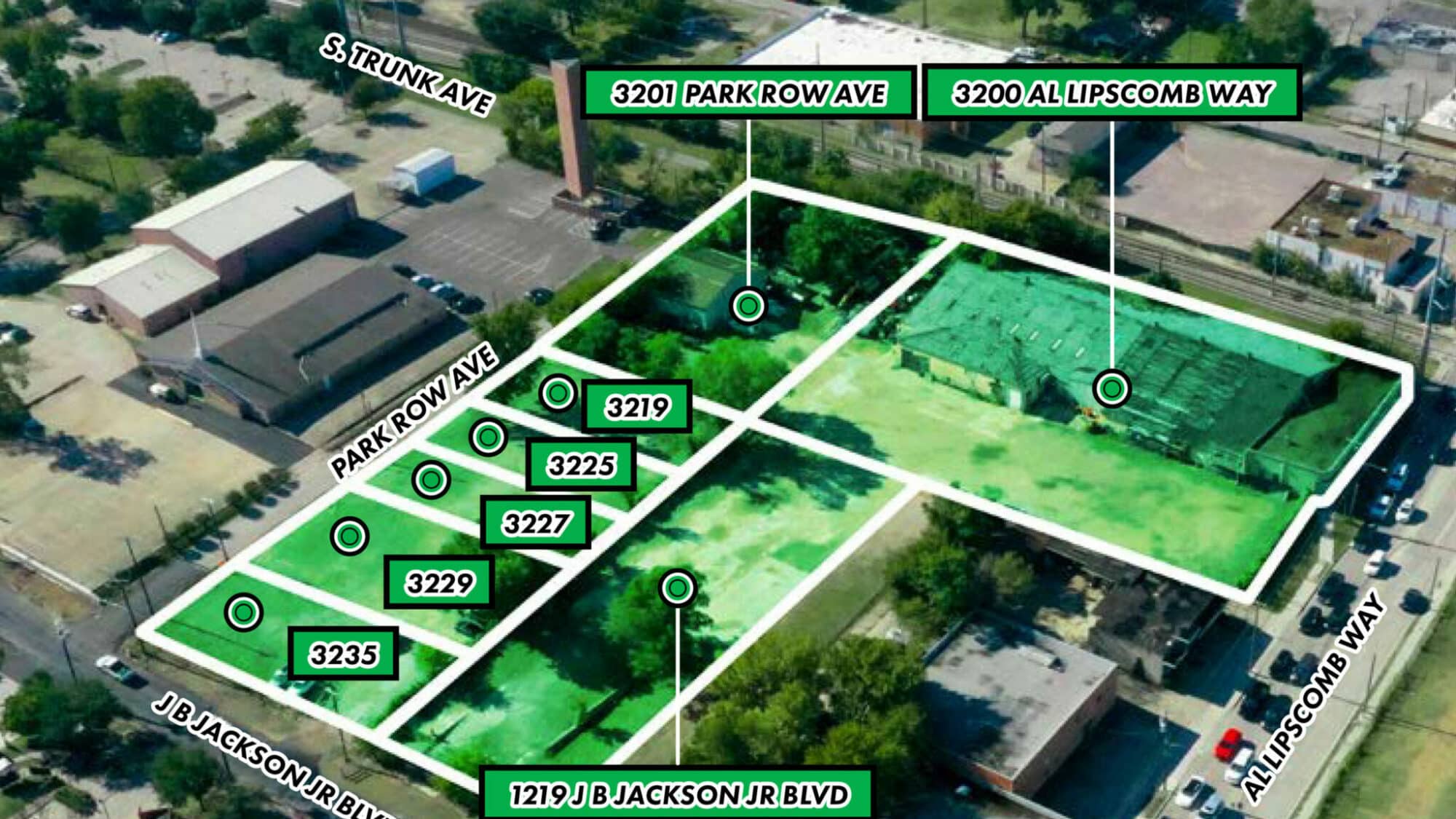

- 35 AC of residential / multi-family land ready for immediate development (additional 4 lots may be available).

- Vacant 27,295 SF industrial building on 3.25 AC of land ready for immediate redevelopment or industrial use.

- Two (2) residential lots totaling 0.29 AC.

- Portfolio boasts significant revenue through parking revenue during Fair Park and other events held at the Fair Park grounds.

Description

Davidson & Bogel Real Estate LLC, as exclusive advisor, is pleased to present to qualified investors the once-in-a-generation opportunity to purchase the Hall Family’s “Core Opp Zone Portfolio” (the “Offering”), located in the heart of Dallas’s urban core, adjacent to the historic Fair Park grounds. Totaling 11.47 AC and owned by a single owner, the Portfolio is the largest compilation of infill assets within Dallas’s coveted urban core in the market today. The Offering provides new Ownership a level of scale not often seen, as well as, the rare ability to acquire a blend of cash-flowing and covered properties, in addition to land sites ready for immediate development. Consisting of 149,926 square feet of improvements and 8.21 acres of land, new Ownership will enjoy a terrific revenue stream with upside potential from the Offering’s various income producing components, most notably the parking revenue, 72,467 SF industrial building and the 3221 Flats Apartments – a 38-unit multi-family asset built in 2016. Furthermore, with over 8.21 AC of land for immediate development at Purchaser’s disposal, the Offering is not only ideal for developers and commercial investors of all product types, but perfect for existing and new Opportunity Zone tax-credit investors.

Due to its strategic infill location, proximity to major employment hubs and traffic generators, the Offering is uniquely positioned to take advantage of everything the rapidly expanding and gentrifying Fair Park market has to offer. Each Property enjoys ease of access to I-30, I-45 and Central Expressway, connecting the entire Portfolio to Downtown Dallas and all other markets within the DFW Metroplex. With a vast majority of the Offering being covered by a diversified revenue stream (without long-term leases encumbering the land), new Ownership benefits from an increased level of flexibility in maximizing future development plans and taking full advantage of the Offering’s infill positioning within a high-growth / high-barrier Opportunity Zone market. Most importantly, with the city’s approval of the new $85+ million Fair Park Master Plan and the continued investment from public and private partnerships / investors, the economic engine of the Fair Park area will continue to churn for years to come.

Location

11.47 AC – Core Opp Zone Portfolio – Dallas, Texas

725 3rd Avenue, Dallas, Dallas County, Texas 75226

Contact Us About this Property