O.B. Mac

Please provide the below information to view this property's offering memorandum.

Highlights

- Legacy infill mixed-use investment located within the coveted Near Southside District of Fort Worth, Texas.

- Historically significant, but not Historically designated, O.B. Mac offers new ownership a once-in a-lifetime adaptive reuse opportunity without the red tape of historic restrictions.

- Offered well below replacement cost at $116 PSF to the improvements and $79 PSF to the dirt, new ownership has the unique ability to enter this high-growth / high-barrier to entry market at an affordable price.

- Excellent infill value-add investment with tremendous upside. Ownership has the unique ability to capitalize on the immediate lease-up of 14,000 SF of office space and increase below market rents on the ground floor (average $11.03 NNN).

- Substantial existing revenue stream with excellent tenancy. Offering provides investors with a terrific mix of high-demand office, warehouse, production and retail space.

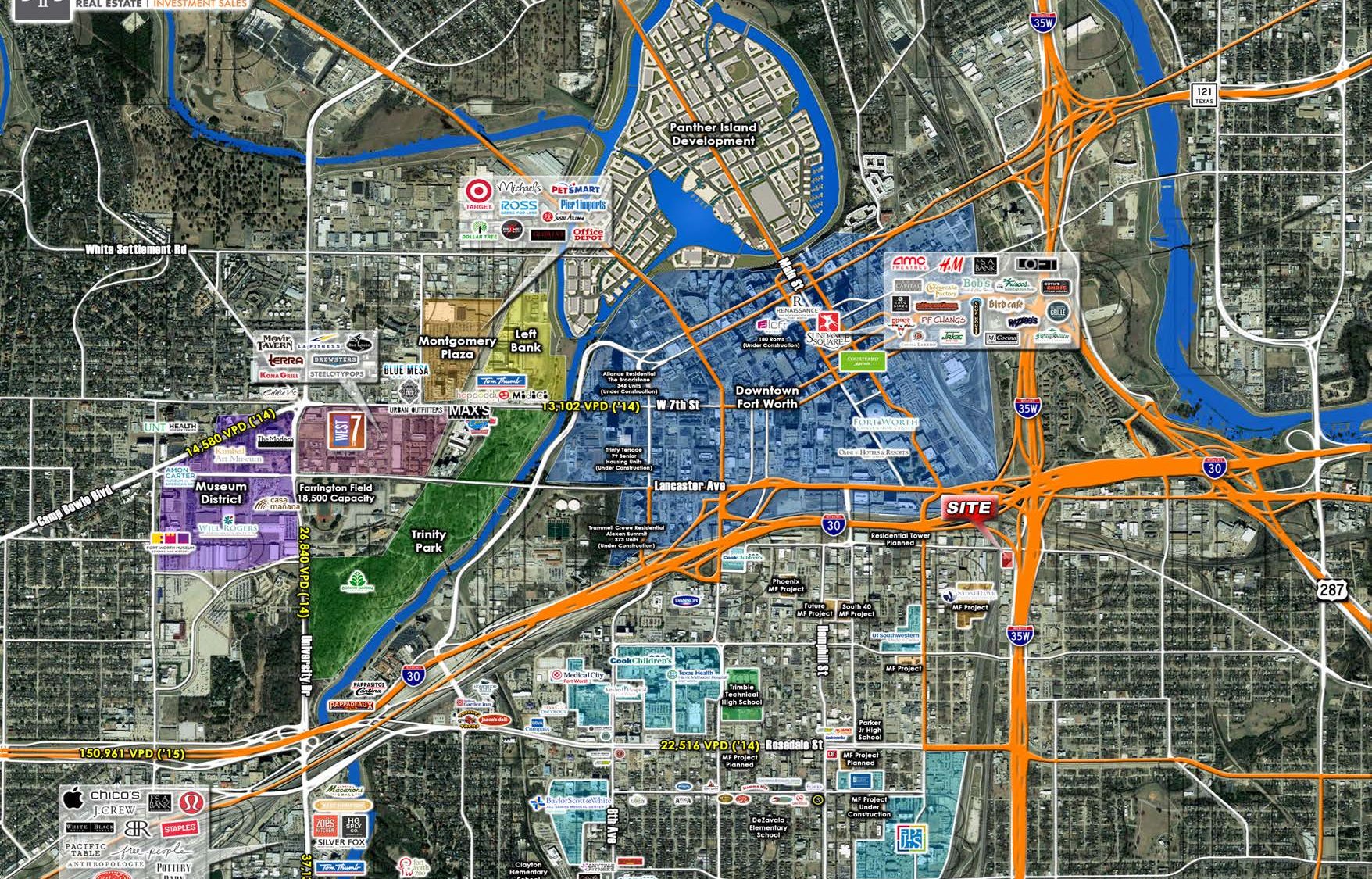

- Irreplaceable infill location within the Near Southside District of Fort Worth. O.B. Mac is strategically positioned just south of Downtown with convenient access to the Interstate 35 and Interstate 30 exchange.

- J Zoning (Light Industrial) – expansive zoning classification permitting various uses with no parking restrictions.

- Unmatched visibility from both I-35 and I-30 and direct access to southbound I-35 on ramp and from E. Vickery Boulevard.

- Approximately 89,0802 residents, 7,544 businesses and 126,235 employees within a 3 mile radius.

- Near Southside is one of DFW’s fastest growing and gentrifying commercial and residential districts. Due to the growth seen over the last eight years, the market has a high barrier of entry for investors and businesses. Since 2010, over 16,640 apartment units have opened with thousands more coming. Furthermore, hundreds of millions of dollars have been spent in new commercial development and adaptive reuse projects over the last several years.

Description

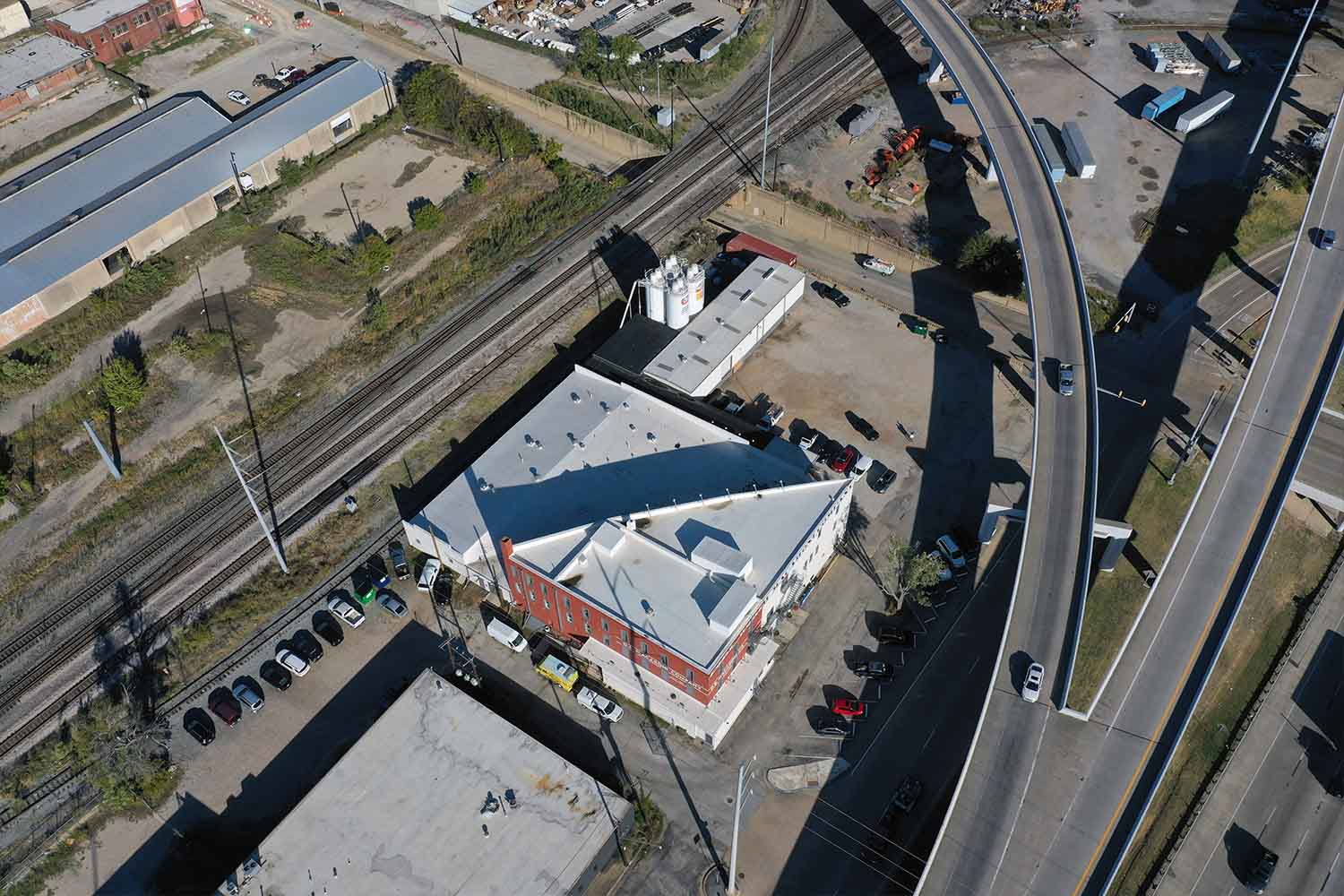

DB2RE INVESTMENT SALES is pleased to present O.B. Mac at 108 S. Freeway (“Property”) a 40,556 square foot historic building on 1.35 AC in the coveted Near Southside District in Fort Worth, Texas. Situated along South Freeway / Interstate 35, the Property benefits from its convenient access to the core of Downtown Fort Worth, Fort Worth Medical District and surrounding amenities. Originally built in 1860, O.B. Mac is one of Fort Worth’s most iconic architectural treasures, serving as the Stage Coach Hotel until 1899 and O.B. Macaroni Company headquarters until 2015. As one of Fort Worth’s most historically significant properties, O.B. Mac has been transformed into a creative office / production facility, currently occupied by an array of iconic Fort Worth establishments which include: Melt Ice Cream, Craftwork Coffee Co., Texas Malt, The Ostreum and W. Durable Goods. A perfect investment for both investors or owner-users, O.B. Mac provides new ownership with a significant revenue stream backed by a first class tenant lineup and tremendous upside through the lease-up of the 14,000 SF of creative office and the ability to push the below market rental rates. Furthermore, the offering allows new ownership the rare ability to enter or expand into this high-growth / high-barrier infill market.

Today, the Near Southside District is one of the most sought after urban markets in the state of Texas. Its strategic positioning within the core of Fort Worth, combined with its unique architectural characteristics has brought about a complete revitalization of the area. With the influx of multi-family and countless adaptive reuse projects, options for businesses are limited. O.B. Mac offers tenants a rare affordable option, strategic access to surrounding markets and visibility from the major thoroughfares. O.B. Mac is ideal for all office, distribution and production needs. Divided into two parts, the property is 65.48% occupied. The ground floor retail and production suites total 26,556 SF and is 100% occupied by five (5) tenants. The two stories of creative office total 14,000 SF and are available for immediate lease-up. As the market continues to tighten, new ownership will be set-up to take advantage of the unprecedented growth.

Location

O.B. Mac

108 S. Freeway, Fort Worth, Tarrant County, Texas 76104

Contact Us About this Property